Mitigating biases: stick to a sound investment plan. Avoiding volatile investments can produce a potential return and may save a significant amount on one’s wealth at retirement

Many investors make decisions based on emotional biases that undermine the chance of meeting their investment goals.

This is the second in a two-part series considering the risks of emotional investing.

Mitigating biases

How does one go about avoiding ‘emotional traps?’

Financial markets without volatility would be unnatural, like an ocean without waves. Like the open ocean, the market is constantly churning and the degree of market volatility varies from small ripples, to rolling waves, to a financial crisis sized tsunami. Despite any negative connotations, volatility simply refers to a change in prices. It is normal and happens over time. It is not necessarily a cause for panic and is something that needs to be considered when investing.

In understanding that prices of stocks and bonds will go up and down, there are things that can be achieved with that in mind. Many investors are uncomfortable with the large amplitudes swings inherent in a volatile investment and thus shun this risk – and the associated return – for less-swingy, lower-return investments. Avoiding more volatile investments simply leaves a lot of potential return on the table and may shave thousands and possibly hundreds of thousands off one’s wealth at retirement. Paradoxically, avoiding risk in long-term investing typically leads to a smaller pool of wealth, feeling far “less safe” in retirement than if one had assumed more risk along the way.

How to respond to market volatility

It might sound counterintuitive but during periods of market volatility, the correct course of action might be to take no action. This is difficult to do because volatility can leave investors feeling vulnerable and concerned that they have to react. That means that investors who jump ship after a ‘big wave’ may break the cardinal rule of investing by ‘selling low.’ Consider this – if you own a home and its value went down this year, would you panic and sell? Most likely, you would not. You bought your house because you knew you would be there a while and so its day-to-day price movement is not as important. The chances are that your home’s value will rise over time and that is what you are focused on.

Be disciplined and stay invested

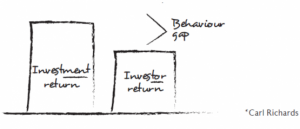

There might be many investors who have made money by seemingly timing the market correctly – in other words, predicting market movements and selling or buying shares accordingly – but it is likely that this was due more to luck than skill. For the average investor it is not only difficult to foresee market upswings and downswings, but also challenging to make decisions that are not marked by emotion.

The golden rule that it’s about time in the market and not timing the market is valuable to investors. We know that markets do not move up in a straight line and that volatility is inherent in equities as an asset class. Checking a portfolio too frequently can make investors more susceptible to loss aversion, since the probability of seeing a loss in a short time period is much greater than over longer time periods. As a result, investors that frequently check their portfolios tend to take a less than optimal amount of risk. True long-term investors are more willing to allocate towards risky assets because they do not care about the short-term ups and downs. Holding a portfolio for long enough increases the probability of a positive return. Research from Putnam Investments on investing offshore in the S&P 500, shows that by remaining fully invested over the past 15 years, would have earned investors $20 460 more than those who missed the market’s 10 best days – more than double.

A goal without a plan is just a wish

Acting on emotion may lead to irrational decisions — and difficult lessons. If you develop a sound investment game plan and stick to it, you will more than likely be in a better position to pursue financial goals. A game plan can help remove emotions from the equation, enable investors to make the most of potential market opportunities; and help preserve assets during periods of volatility. Investors who are not saving for a goal and/or do not have the discipline to remain invested during the time saving for a goal, are more likely to realise the waves of volatility that occur over their period of investing. In contrast, investors with clearly defined goals, that are able to shift their focus on the potential of meeting their needs and requirements, have the luxury of realising infrequent negative market returns. There is unfortunately no assurance that an investment strategy will be successful but investing with a clear plan provides a higher probability of meeting your goals/needs.

Conclusion

The industry is learning more and more about emotional biases and the effect on individual investors. But it seems that adhering to a sound investment plan may be one of the best ways to avoid the pitfalls set by our brains.

Albert Louw is head of business development at Stanlib Multi-Manager