The success of any resilient, all-weather portfolio lies in the waiting.

We were all hoping for a bit of a breather going into 2022. But as if the pandemic wasn’t enough for all of us, the year so far has proven to be very eventful.

The year started with the Russian-Ukraine conflict, rising interest rates and inflation both locally and globally, and ultimately we have seen a bear market.

Human nature unfortunately experiences a loss much more intensely than a gain. We have very quickly forgotten about the 20% to 30% returns we enjoyed in 2021.

When it comes to “timing” the market and timing the turnaround, doing so successfully is unfortunately impossible. If we could do that, we would all have been billionaires by now. The success of any resilient, all-weather portfolio lies in the waiting. The time IN the market.

Unfortunately, many investors struggle with the pain of the market cycle, and the required patience that comes with it. Rather than waiting volatility out, many opt to either withdraw their funds or switch to cash. These are potentially life-changing decisions.

Firstly, changing your portfolio in a downward cycle locks in losses. You were never “losing money”. You still own every unit of every company in your equity exposure, the value is just changing day to day. But by selling units at a “low price” you are now losing out.

Secondly, switching your entire portfolio to cash, at any point in time, is never advised. Cash is currently yielding just over 5%. Inflation just reached 7.4% in SA. This means you are effectively losing money every single day. A well-diversified portfolio, which includes all the asset classes, is always advised. The different asset classes complement each other as they behave differently through different cycles, and combining them is definitely a safer route than seeing one asset class as an alternative to another.

As Paul Samuelson said: “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas”

Success lies in waiting, and in being in the right place at the right time when the positive days come. The market, has and always will, go through cycles. The graph below illustrates the impact on your portfolio if you missed out on just 15 of the best days in the market over a period of almost three years. Let that sink in… only missing 15 good days over a period of 2.5 years could halve your portfolio outcome.

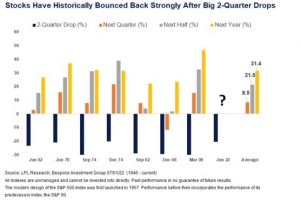

Although we cannot time exactly when the market will turn again, history does provide some guidance and the nature of an asset class can still be understood and expected. After every bear market a bull market will follow, and vice versa. Stocks have historically bounced back after a two-quarter drop.

I recommend working with a financial advisor when managing a portfolio and the financial goals and planning that come with it. Even if you have the skill to do so yourself, or the interest. Having an objective opinion protects us from making emotional decisions during difficult cycles, ensuring we don’t make decisions that might change our financial future forever.

Article by Elke Brink – PSG Wealth