Understanding the fundamentals creates a solid investment foundation with better investment expectations. For those familiar with the game of golf, there is a saying “drive for the show and putt for the dough”. That simply means that a putt can either make or break you on a golf course, not necessarily how hard or […]

A good read compiled by Nedbank Investments especially applicable during this lock down period about managing your emotions and staying invested. Continue reading

Watching the value of your investment tumble over the course of just few days can be a painful experience. The global market crash that we’re experiencing has been unlike anything most seasoned investors have seen before, in its speed and severity. So if you’re new to investing, you certainly wouldn’t have seen an equity sell-off […]

Mitigating biases: stick to a sound investment plan. Avoiding volatile investments can produce a potential return and may save a significant amount on one’s wealth at retirement Many investors make decisions based on emotional biases that undermine the chance of meeting their investment goals. This is the second in a two-part series considering the risks […]

Investment decisions can easily be driven by emotions and chance. Time in the market, rather than timing the market, is far more valuable to investors Since investors rarely behave according to financial and economic theory, behavioural finance has grown over the past twenty years. Most investors know that emotion affects the way in which investment […]

An excellent youtube clip of equity returns relative to inflation. Clip by Corion Capital

A key question is whether an investment in cash is going to help you achieve your long-term objective. Equities have been under pressure for a while, which has skewed the traditional risk-return dynamic in asset classes. Typically, cash is on the conservative end, with lower risk, but also lower return prospects, while assets such as […]

The financial aspects of our lives can be vast and overwhelming, so it’s easy to understand why it causes confusion, or perhaps anxiety and distress. The task of managing your personal wealth can be broken down into many little pieces, and key among them, whether you’re an experienced investor or just starting out, is to […]

During periods of underperformance, even the most experienced investors get tempted to switch funds in search of better returns. However, switching funds in response to short-term market conditions can jinx your investment success over the long term. After a flat few years, 2018 was particularly difficult for local investors, with the FTSE/JSE All Share Index […]

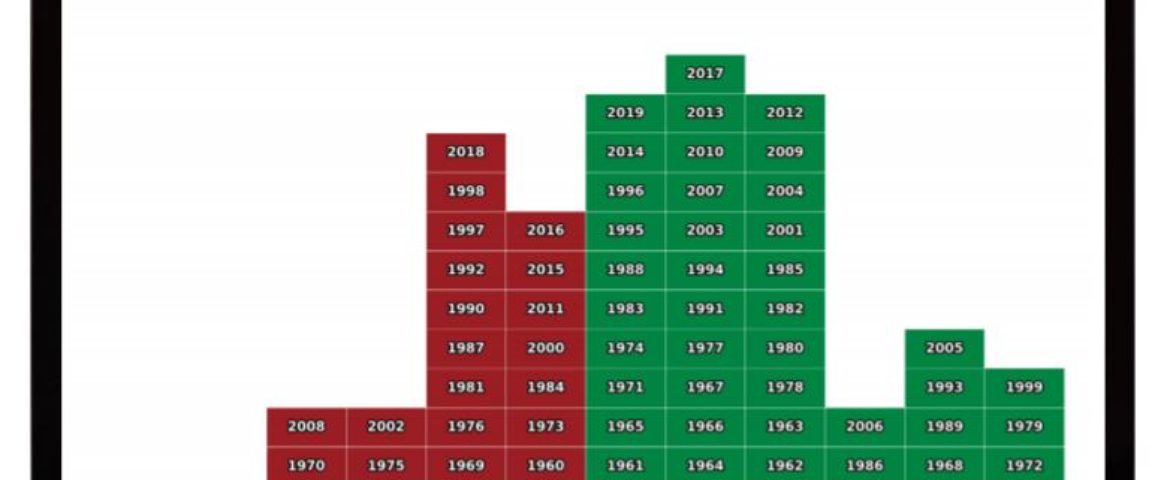

The biggest risk to investors : their own capitulation especially as harsh market reality leads to investor fatigue The last five years on the JSE have been incredibly hard. Investors in the local market have received returns only barely above inflation. As the graph below shows, this is one of the worst five-year periods on […]