These days when I phone my mother just to check in, she always tells me that growing old isn’t easy. Between medical expenses and day-to-day living, their wallets pretty much stay empty. I know for a fact that my mother isn’t the only one who feels this way. Most people facing retirement soon, or who are already retired, will agree with her.

The reality is that things haven’t been, and still aren’t easy. And although I wish I could predict what the markets will bring in the near future, unfortunately, I can’t. But I would like to discuss a few issues that investors actually do have control over in their personal investment-linked living annuities (ILLA) that could give them a fighting chance:

- your asset allocation;

- what your withdrawal rate is;

- what you pay for your ILLA and the advice and services involved.

I think I’ve discussed the costs attached to various investments and what to look out for so many times over the years, and I must say that I think the industry has come a long way in that respect over these last few years. But it’s withdrawal rates and asset allocation that I would like to discuss in more detail.

Withdrawal rate

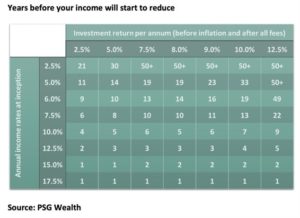

The Association for Saving and Investment SA (ASISA) provides guidelines on how long clients can expect to draw a real income from their annuities at different drawdown rates and given different returns. PSG Wealth has expanded the standard ASISA table to include additional return and drawdown scenarios below:

Assumptions: income drawdown rate is adjusted over time to maintain a real income by allowing for inflation of 6% a year.

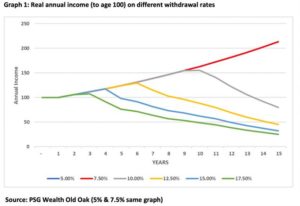

Let’s assume that six people retired at the same time 15 years ago and each chose a different annual withdrawal rate on their ILLA of 5%, 7.5%, 10%, 12.5%, 15% and 17.5% respectively. Let’s also suggest that all of them invested their capital in the average SA Multi Asset Low Equity fund sector. Given the positive market environment 15 years ago, all six investors would have managed to maintain their inflation-adjusted income for the first two years.

But when we take a look at Graph 1 below, it becomes clear that the investor withdrawing the maximum of 17.5% from their ILLA, wasn’t able to sustain the purchasing power of their retirement income over time and had to face a decreasing income each year over the following 12 years. The investor withdrawing 15% followed closely by having to face their first decrease in year four. The investor withdrawing 12.5% would have had to get by with an annual decrease from year six, while the investor withdrawing 10% annually, would have faced their first decrease in year nine.

Despite the fact that both the 5% and 7.5% withdrawers were able to maintain real growth in their respective incomes over this 15-year period, the end values of their respective ILLAs tell a completely different story. The investor who withdrew 5% pa would have had an ILLA value equal to 84% (or 4.1% per annum) more than their initial investment, while the person who withdrew 7.5%, would have had 13% less (or -0.9% per annum) than their initial investment, and would probably end up joining the others with a decreased income fairly soon.

It is possible, however, for your financial adviser to supply you with a cash flow projection based on different withdrawal rates over different periods, even before you retire. Of course, there will be a number of variables that could affect the outcome of your investment adversely, but at the very least, it can give you an idea of how long your capital may last. It is also a helpful tool after retirement, as it can help you to make changes if needed before your withdrawal rate becomes a big problem.

Asset allocation

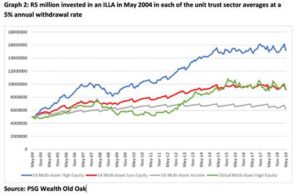

This is an area where investors just love to listen to other people, and also an area where they should be VERY careful. The first lesson is that last year’s winners are not necessarily tomorrow’s champions. Secondly, diversification. It is, and always will be, your best defence against market fluctuations. When we consider the four main asset allocation unit trust sectors, namely the SA Multi Asset Income, SA Multi Asset Low Equity, SA Multi Asset High Equity and Global Multi Asset High Equity sectors (keeping in mind that when it comes to your pension/ILLA, you should NEVER invest in only one asset class), and we weigh the performance of each asset class against the investor with a 5% withdrawal rate, it’s not hard to see why someone like my mother is finding it hard to keep up financially. Over the past five years (up to the end of May 2019), only investors who invested all of their capital in the global sector, would have received positive returns. And that is why so many South African investors feel that you should invest all of your capital invested offshore.

When you look at the bigger picture, however, things start to change, and please also remember that not all investors have the same risk profile. In Graph 2, you will see how an ILLA would have performed in each of the four main asset classes over the last 15 years with a 5% annual withdrawal rate. It becomes clear that the investor who chose the average SA Multi Asset High Equity Fund above the Global Multi Asset High Equity Fund would have performed much better over the longer term. And those who decided to take even less risk and invest in the average SA Multi Asset Low Equity Fund, would have enjoyed the same perks as the global fund investors, only with a lot less stress.

I’m not saying that one asset class is better than another. It’s all about finding the right asset allocation to suit your needs and ultimately make your money go further.

In the end, though, it’s not just the one or the other, but rather a combination of these two main factors and thorough planning along with your financial adviser, that will help you achieve a more comfortable retirement.

Article by Schalk Louw – a portfolio manager at PSG Wealth.