‘Stay the course’ is a phrase that has its origins in nautical metaphor and has been popularised by world leaders primarily in the context of war or battle. According to Stewart Alsop’s 1973 memoirs of a conversation with Winston Churchill, the British Prime Minister contemplated towards the end of World War II: “America, it is a great and strong country, like a workhorse pulling the rest of the world out of despond and despair. But will it stay the course?”

We ask the same question today of South African investors, after what has been a challenging battle for returns over the past three years. It is often, but not certain, that investors capitulate at the exact moments when they require fortitude and resolve. Behavioural biases are the primary drivers of capitulation and can wreak havoc on long-term portfolio returns. Therefore, it is vital that as investors we remain vigilantly aware of how ‘animal spirits’ can drive irrational decision making and that we adopt a reasoned framework for investing for our future lives.

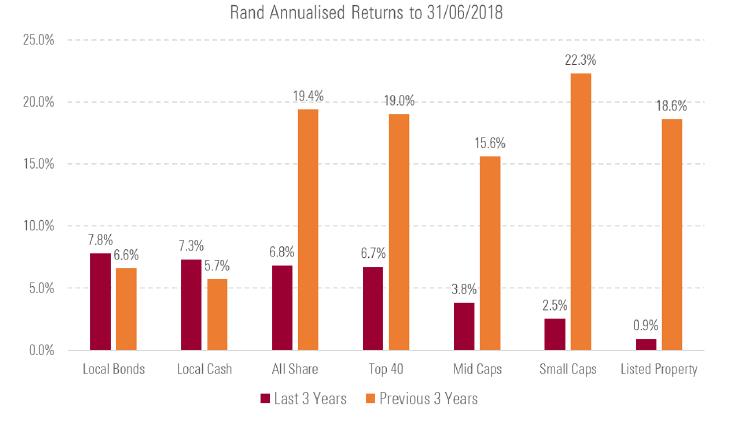

Slide below – The local return environment has been difficult over the past three years

In South Africa, it has been a tremendous battle for investors over the past three years. In comparison to the previous three-year period, equity returns are substantially lower, which has led to disappointment among many investors. The source of this disappointment could represent a level of behavioural conditioning at play, with investors not achieving the returns anywhere near their expectations – which are often extrapolated using historical returns. In this sense, the recency bias is pertinent. For instance, three years ago a presumptuous investor may have expected say a 15-20% return from investing in local stocks based on the prior three-year return. This use of easily recalled short-term information is a classic error on the part of many investors, which may apply again today for opposing reasons. This time, investors are looking at the most recent period of lean returns and some, with a hindsight bias and the herd mentality at play, are expecting poor returns to persist into the future. In addition, with high cash rates on offer, some will further justify to themselves that reward for risk is not sufficient. This thinking is usually well intentioned, although must be put in perspective. Specifically, we believe it is important to effectively zoom out and consider how risk assets can be expected to perform from current valuations and over the longer term. One means of building this understanding is to look out over longer time horizons, which helps align expectations with actual investor time horizons.

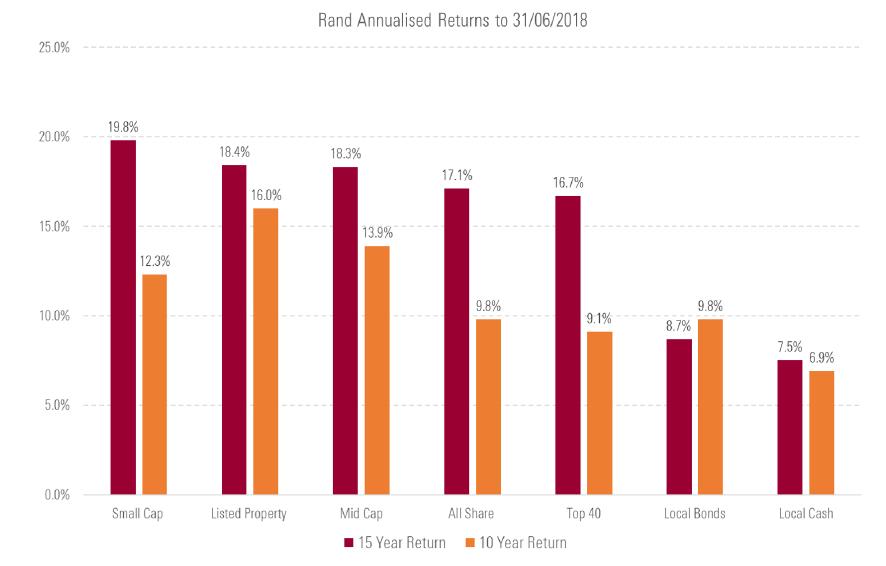

Slide below – 10 and 15-year annualised returns for South African asset classes

Markets will go up and they will go down, of this you can be certain. We all wish we had crystal ball to predict when these gyrations would take place, but in reality, this is an arduous task. Investing, like many things, involves taking the thorns with the roses. As Exhibit 2 indicates, risk assets have delivered strong returns to investors over the long term – despite the poor performance in recent times. While we are certainly not predicting that this past performance will repeat itself, we think it is important to have context when evaluating opportunities and performance. In this respect, investors who had remained invested through a 15-year period (up to 31/05/2018) would have earned a healthy 16.7% per annum from equities (FTSE/JSE All Share TR) despite major market disruptions such as the Global Financial Crisis. The central principle is that no one can predict market inflection points with precision. Over hundreds of years and through all investment literature there is one golden thread – the evidence clearly favours staying the course.

By observing the essential characteristics of successful investors, it is clear that patience is a prerequisite. We believe that it is easy for investors to get wound up from a behavioural point of view by placing too much emphasis on macro-economic trends that are often sensationalised by the media to grab readers’ attention. This opens the door for behavioural biases, which can wreak havoc on portfolio returns through emotionally-motivated decisions that are often based on imperfect information. We want to control these biases, maintaining a strong awareness of where they can creep into our portfolios. Our principles guide us along this treacherous path and provide a framework to nullify the potentially damaging effects of focusing on what is beyond our control in portfolios. Instead we choose to focus on what we can control. “Investing is simple not easy” – Warren Buffett

Underpinning this approach is that investors should not make short-term predictions, thereby avoiding placing too much importance on cyclical behaviour. This type of behaviour is akin to speculation. There are very few, if any, successful investors that have been able to time the market for consistent gain, and often this is linked to what is referred to as the overconfidence bias. We avoid this bias by focusing on the long term and being very aware of the dangers that come from extrapolation. “Only liars manage to always be “out” during bad times and “in” during good times.’ – Bernard Baruch

Another method we advocate is to apply a strong fundamental focus throughout the investment process. We should all seek to understand in great depth what the fundamental drivers of returns are within assets and asset classes. Most importantly in this regard is the sustainability of cash-flow growth, which drives present and future valuations. “Know what you own, and know why you own it.” – Peter Lynch

Lastly, investors should have a broad understanding of valuation. The price you pay for an asset can ultimately influence your return, so applying a contrarian mindset could help bolster your success. We seek to use a well thought out valuation-driven framework to identify assets and asset classes that are attractive on a long term fundamental basis. Often assets that are attractive on this basis will have considerable headwinds and many naysayers, however we believe that the most credible and sustainable ways to deliver outperformance is to buy assets at below their intrinsic value. This is a strategy backed up by numerous research efforts and our own observations of the most successful money managers globally. “Be fearful when others are greedy. Be greedy when others are fearful.” – Warren Buffett

Bringing this together, we believe that investing is a long-term pursuit of allocating to assets that are fundamentally undervalued. Ultimately, we believe that time in the market is a superior strategy to timing the market and an investor can improve their likelihood of success by using a valuation-driven approach. So, if you catch yourself getting down about the state of the equity market or trying to predict what’s next, keep in mind these principles and remember that a broken clock is correct twice a day. “The individual investor should act consistently as an investor and not as a speculator.” – Ben Graham

Kyle Cox CFA | Investment Analyst |Morningstar Investment Management